While annual allowance is a flat rate given. 1311 Living quarters allowance hereinafter referred to as LQA means a quarters allowance granted to an employee for the annual cost of suitable adequate living quarters for the employee and hisher family1312 Rent exclusive of heat light fuel including gas and electricity water.

In pay grade E-6 or below and assigned to the US.

. Personal Income Tax. Capital allowances consist of an initial allowance and annual allowance. Calculate the capital allowance.

Permanent duty annual replacement payment. Your Name First Name Middle Initial Last Name Social Security Number or CalPERS ID Birth Date mmddyyyy Daytime Phone Alternate Phone. State ZIP Enter the address we have on le for you.

If you need to update your address see the back of this form for instructions. 8 Oktober 2018 INLAND REVENUE BOARD OF MALAYSIA _____ Page 2 of 19 43 The conditions that must be fulfilled by a person to qualify for an initial allowance IA and an annual allowance AA are the same as the conditions to claim capital allowances at the normal rate under Schedule. IA is fixed at the rate of 20 based on the original cost of the asset at the time when the capital was obtained.

130 LIVING QUARTERS ALLOWANCE Last updated 7102016. Standard Initial Clothing Allowance Submarine Pay Submarine Pay. The proposed bonus of 24 was floated by Rep.

The International Civil Service Commission ICSC is aware of various schemes being circulated via e-mails ie. Annual allowance is a flat rate given annually according to the original cost of the asset. 72018 Date Of Publication.

She would in tax. Jared Golden as part of a proposed amendment to the 802 billion annual. Temporary duty of at least 15 days in a 30-day period.

However investment allowance does not reduce the cost of an asset in order to calculate the annual allowance while initial allowance reduces the cost of an asset. In this case in terms of tax only Jane would be better off going for the car allowance since the income tax works out lower than her income tax BIK with the company car. Retirement Allowance Estimate Request.

And the Partial Initial Clothing Allowance for a member of the Reserves or Guard called to active duty is. Accounting year ends on 31 December. Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred.

Permanent duty initial payment. In April 2018 Company Bee bought furniture and fittings for NGN 1000000. The annual allowance is distributed each year until the capital expenditure has been fully written off.

Navy Band Washington DC or the US. Total Income Tax Owed.

Notes Capital Allowance Capital Allowance Capital Allowance Is A Tax Relief For A Business Who Studocu

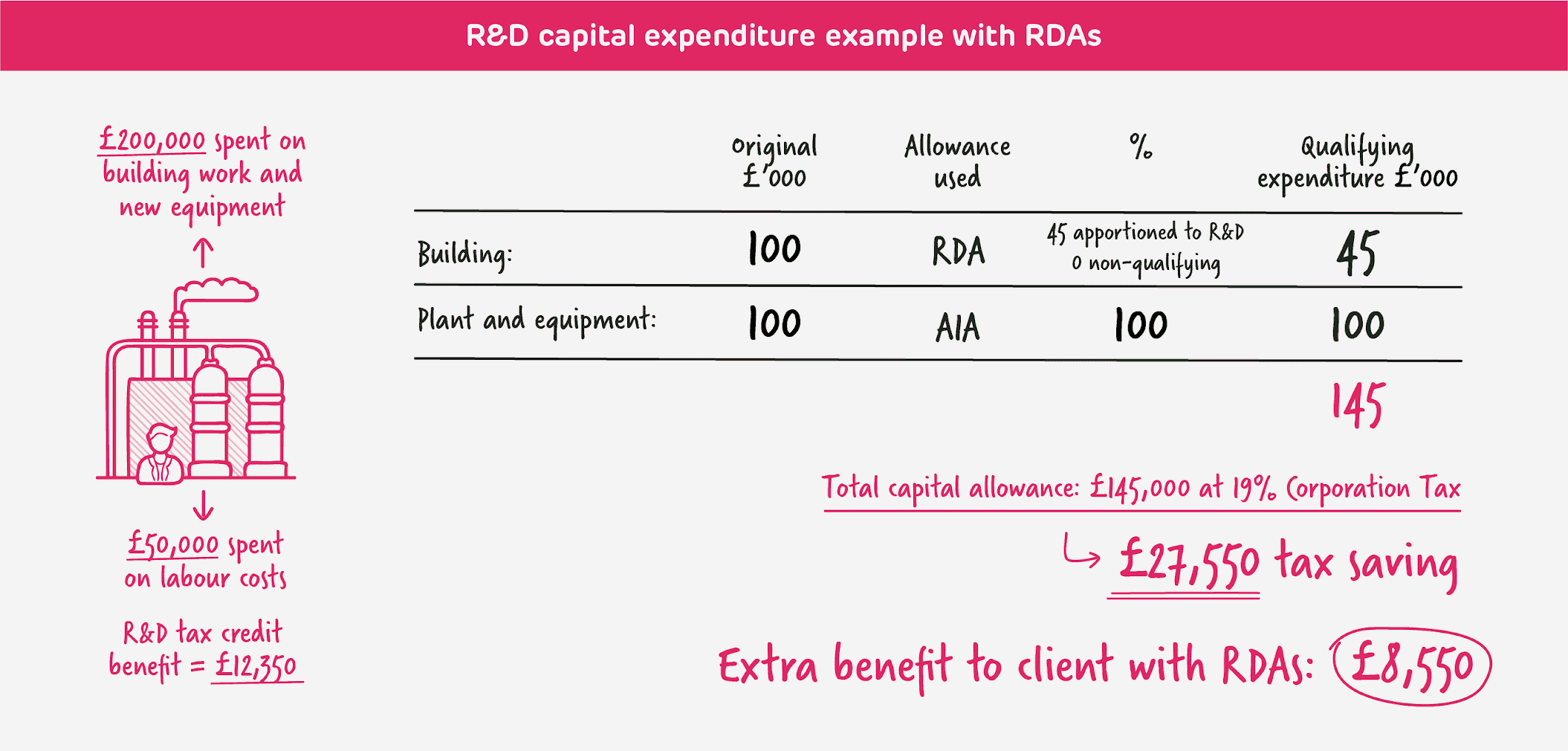

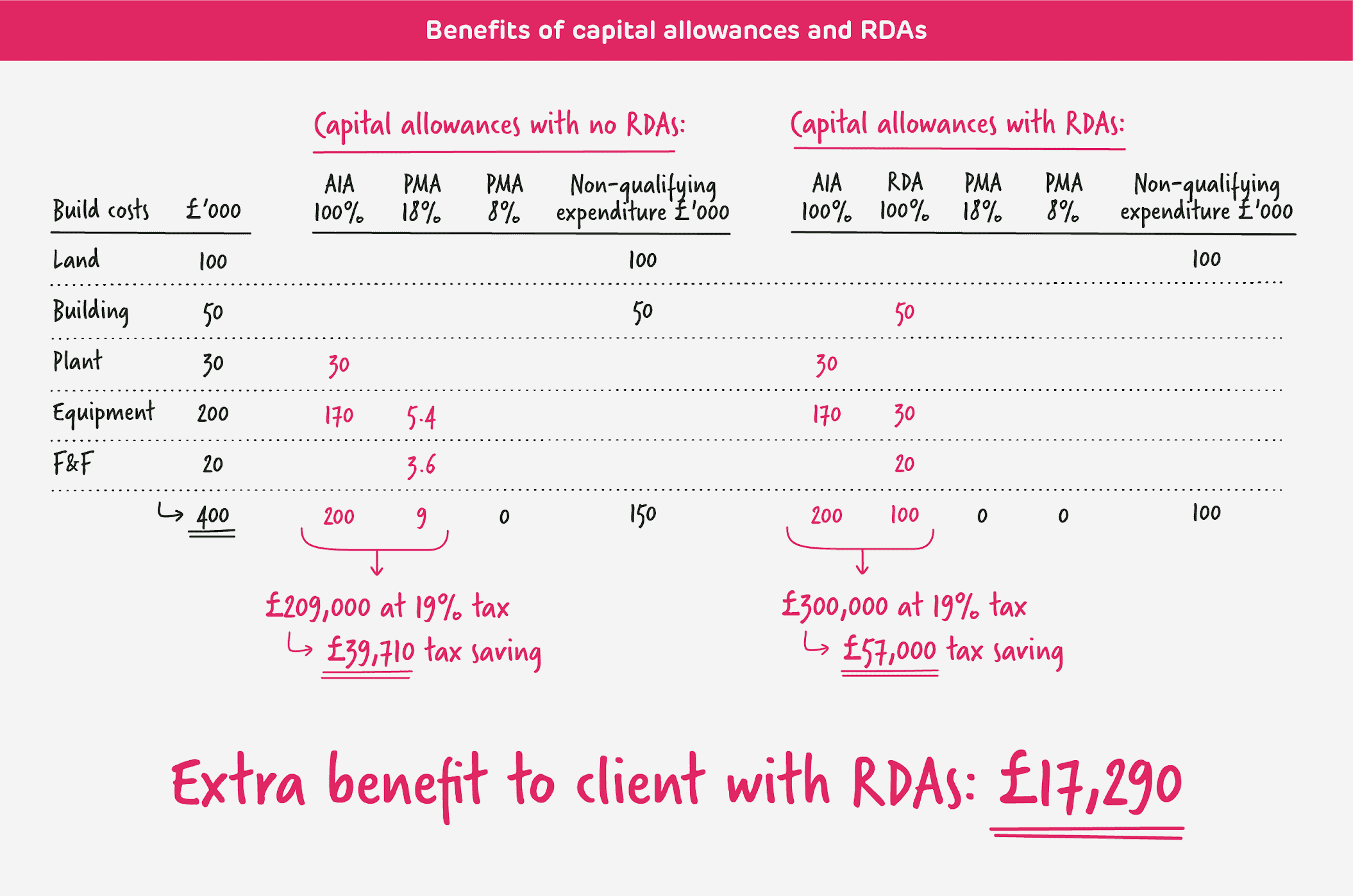

R D Capital Allowances R D Capital Expenditure Explained

:max_bytes(150000):strip_icc()/Boeing_Customer_financing-dd3b8773bd8d4654b734575f23d51d62.png)

Allowance For Credit Losses Definition

A Guide To Tenant Improvement Allowance Accounting Faqs Answered

Balancing Charge Or Balancing Allowances

A Guide To Tenant Improvement Allowance Accounting Faqs Answered

What Is Capital Allowance And Industrial Building Allowance How To Claim Them Anc Group

Explore Our Example Of Offer Letter Of Hire Template For Free In 2022 Letter Templates Lettering Money Template

Ms 3255 Business Taxation Capital Allowances Plant And Machinery Ppt Video Online Download

Capital Allowances Introduction Part 1 Acca Taxation Tx Uk Youtube

Balancing Adjustments On Pools And Review Of Capital Allowance Computation Acca Taxation Tx Uk Youtube

A Guide To Tenant Improvement Allowance Accounting Faqs Answered

/Boeing_Customer_financing-dd3b8773bd8d4654b734575f23d51d62.png)

Allowance For Credit Losses Definition

R D Capital Allowances R D Capital Expenditure Explained

Balancing Adjustments On Pools And Review Of Capital Allowance Computation Acca Taxation Tx Uk Youtube

Postgraduate Scholarship For Students Of Balochistan May 2021 Advertisement Scholarships Postgraduate Graduate Scholarships

Living Abroad What About My South African Family Trust Family Trust South African South

Capital Allowances Introduction Part 1 Acca Taxation Tx Uk Youtube

Capital Cost Allowance Canada Youtube